Mark Oppenheimer, who writes the Beliefs columns in The New York Times, argues for ending the non-profit tax exemption in the wake of Obergefell v. Hodges, the landmark Supreme Court case on marriage for same-sex couples.

From the op-ed:

The Supreme Court’s ruling on gay marriage makes it clearer than ever that the government shouldn’t be subsidizing religion and non-profits

Oppenheimer notes that Senator Mike Lee of Utah publicly fretted that the case would possibly result in churches losing their tax exemption, and disagrees with liberal voices portraying Lee’s words as hyperbolic. Rather, Oppenheimer, a supporter of gay rights, claims that Lee is probably correct about the likely outcome of the case.

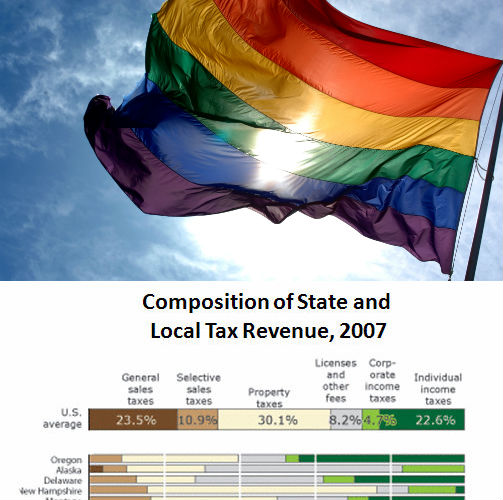

Oppenheimer builds his case at the intersection of social justice and taxation–taking so much property off of tax rolls cuts into the coffers of cities and towns–and mentions that some clergy are paid six-figure salaries. (Note: The average salary is a much more modest $47,730 Figures US Department of Labor) Many churches currently employ clergy in part-time capacity, without benefits and with very low pay, but require much greater time commitments than they are compensating.

Oppenheimer also notes that operating soup kitchens, clothing drives, and other charitable actions cost money and provide public good, but asserts that it’s properly the job of the government. This doesn’t take into account how poorly the government currently does these jobs; from drug war policy to incarceration to homelessness programs, America continues to lag behind other modern nations in alleviating suffering and decreasing poverty.

What do you think? Do you see the link he references between this case and tax-exemption? Do you agree with his points? What do you think would happen to quarter time and half time clergy with the elimination of the exemption? Do you think some of the objections that could be raised have solutions missed in this article?